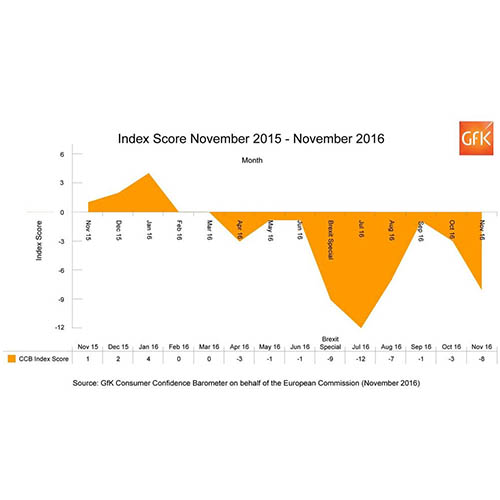

GfK’s Consumer Confidence Index dropped five points in November to -8, continuing the trend seen since the Brexit vote.

All five measures in the index saw decreases in the month, with the Major Purchase Index decreasing nine points to +5, which is four points lower than this time last year and nine points lower than October.

The measure of the general economic situation for the UK over the past 12 months dropped by six points to -25, which was 19 points lower than November 2015.

Meanwhile, the index for the general economic situation over the next 12 months decreased five points to -22, which was 16 points down on the same month last year.

Joe Staton, head of market dynamics at GfK, said: “The slump across the board this month points to continuing uncertainty about the state of the economy among consumers. Although scores for our personal financial situation just about remain positive, the big theme is the reduced confidence in the UK economy looking back and ahead. We are viewing our economy over the past 12 months with increasing despondency. The decreasing score on the economy for the next 12 months also shows we are resolutely gloomy about the outlook despite strong GDP numbers. The ‘next 12 months’ figure has been low since the June vote to leave the EU as ongoing economic turmoil, inflationary pressures and global anxiety impact our levels of confidence.

“And is this gloomy mood also affecting spending intentions? Despite recent strong retail sales, we are reporting a sharp nine point drop in the Major Purchase Index this month and this will be an acute concern for retailers as they gear up for the key Christmas selling period. Many are saying that fears about the British economy have been overstated, but time will tell if the pessimism shown in the index is misplaced or not.”

Alex Marsh, managing director of Close Brothers Retail Finance, added: “Black Friday saw a surge in online sales but failed to match high street retailers’ expectations, as shoppers preferred to make purchases online rather than in-store. Our own data showed that over a third of all purchases on finance over the weekend were made by millennials, which could explain this online shopping trend. This trend, coupled with today’s data showing a lack of consumer confidence, means retailers need listen to their customers’ needs and adopt an omni-channel approach as we head into the Christmas shopping season.

“Higher inflation on the horizon will be a challenge for many retailers as the spending power of consumers change, which could cause confidence to dip further. Retailers will need to adapt to meet consumer needs including offering flexible payment options, allowing them to spread the cost of purchases in line with their disposable income in a higher inflation UK.”